Significant Cut to Its EV Investment, Honda Seems to Overlook Its Honda e:N1 in Southeast Asia

RobertMay 21, 2025, 05:37 PM

RobertMay 21, 2025, 05:37 PM

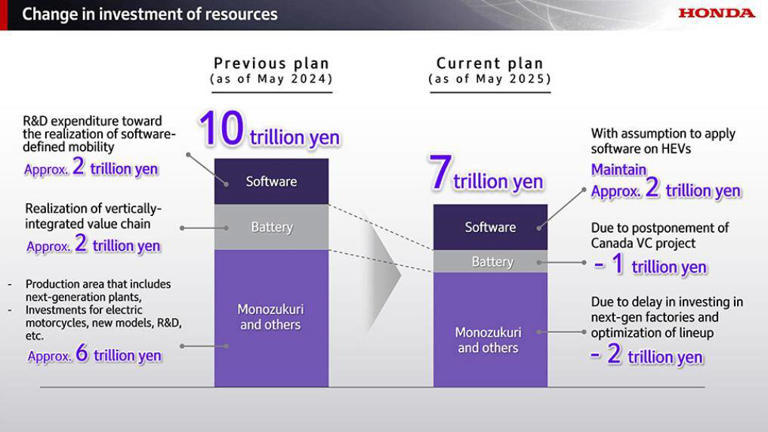

【PCauto】On May 20, 2025, Honda revealed it will reduce its originally planned investment in electric vehicle development from 10 trillion yen to 7 trillion yen.

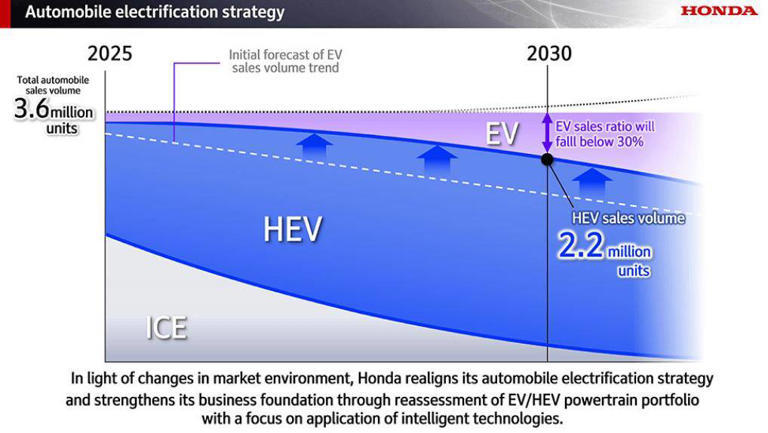

Additionally, the sales target has been drastically lowered—from an initial goal of over 2 million vehicles by 2030 to a revised range of 700,000 to 750,000 vehicles.

Construction plans for EV and battery factories in Canada, originally set to commence production in 2028, have been postponed to beyond 2030, with future investment dependent on market conditions.

Honda cited two main reasons for these adjustments:

Firstly, the uncertainty surrounding the U.S. government's reevaluation of electric vehicle support policies has impacted Honda's global strategy.

Secondly, the demand for electric vehicles has not met expectations, with the pace of EV adoption slower than anticipated. Concerned about the risks of further large-scale investments, Honda has decided to scale back its efforts.

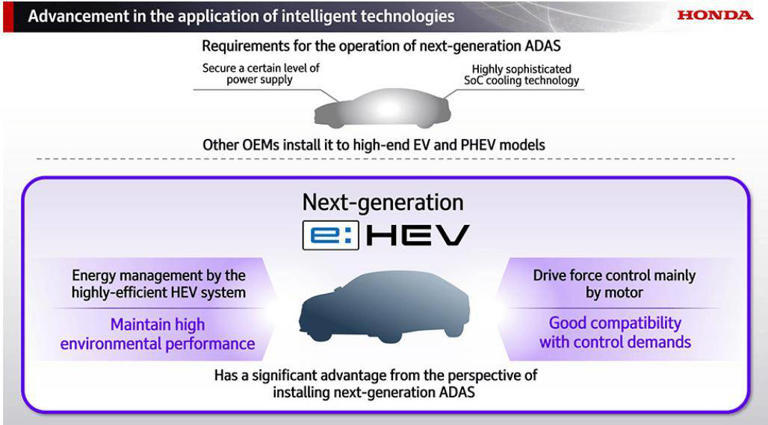

Moving forward, Honda intends to allocate more resources to hybrid vehicles. The company views hybrids as a key transition to electric mobility and plans to launch 13 new-generation hybrid models globally over the next four years, starting in 2027, with a target of selling 2.2 million hybrids by 2030, thereby boosting overall vehicle sales beyond the current 3.6 million.

Honda also aims to reduce production costs for hybrid systems, targeting a cost reduction of over 50% for its next-generation hybrid systems compared to those used in 2018 models, and over 30% compared to the 2023 model systems.

In announcing this business adjustment, Honda seems to have overlooked its recent e:N1 launch in Southeast Asia (Thailand launched on March 24 and Malaysia on May 15). This certainly undermines market confidence in the vehicle, but Honda appears unconcerned.

Since Honda has admitted to its challenges in the electric vehicle sector and is cutting back on its investments, indicating that the Honda e:N1 is not competitive.

Honda’s experience in the electric vehicle market traces back to China. Around 2020, both Honda and Toyota launched EV versions based on their respective small SUVs. While Toyota introduced the C-HR EV, Honda developed the M-NV based on the XR-V. Both models ultimately failed due to excessively high pricing.

What followed was different for the two companies. Toyota implemented a Regional Chief Engineer system in China, allowing local engineers to take charge of vehicle development.

In contrast, Honda maintained an arrogant stance toward EV development, ignoring market feedback. From the initial M-NV to the e:NP series and e:NS (which includes the Honda e:N1), Honda introduced its sub-brands and the Honda S7 and P7 models in 2024. However, the branding angered local consumers, leading to three consecutive failures in the electric vehicle space.

In North America, the AFEELA 1, developed in partnership with Sony, has also faced scrutiny. Priced at $89,900 (approximately RM383,513), the AFEELA 1 does not deliver the groundbreaking technology expected: a maximum range of 483 km (EPA), 490 horsepower, over 40 sensors, an 800 TOPS computing capacity for smart driving chips, and a wide seamless interior screen. Comparatively, it falls short against local Chinese products priced around RM300,000, not to mention that the AFEELA 1 won’t be available until next year.

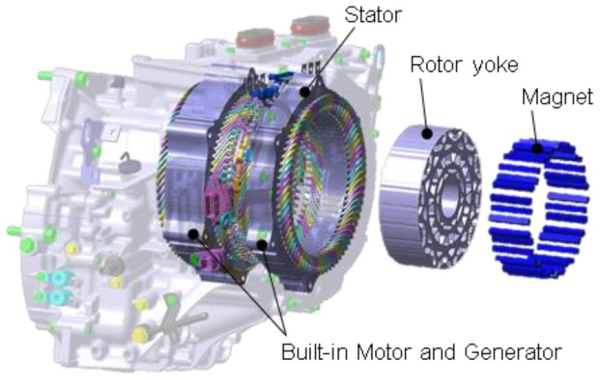

In the realm of hybrid technology, Honda’s i-MMD and BYD’s DM-i both employ a dual-motor parallel and series hybrid structure. Both systems feature a direct connection between the drive motor and the differential, as well as a direct link between the engine and generator. The engine can drive the vehicle directly via a clutch, allowing for multiple driving modes—pure electric, series, and parallel—across different operating conditions. Additionally, both systems can easily integrate into plug-in hybrid electric vehicle (PHEV) configurations. However, BYD’s global sales reached 4.27 million units in 2024, while Honda lagged with 3.71 million units (a year-on-year decline of 9.6%). When it comes to cost reduction, BYD benefits from economies of scale achieved through higher sales and a fully integrated supply chain—advantages that leave Honda with little room to lower hybrid technology costs.

However, BYD’s global sales reached 4.27 million units in 2024, while Honda lagged with 3.71 million units (a year-on-year decline of 9.6%). When it comes to cost reduction, BYD benefits from economies of scale achieved through higher sales and a fully integrated supply chain—advantages that leave Honda with little room to lower hybrid technology costs.

Honda is known for its distinctive character as an automaker, having overcome numerous technical challenges through its intense focus. The extensive research published by Honda R&D showcases its formidable technical reserves, establishing it as a brand that can legitimately speak to its technological prowess, perhaps even more so than “Technology Nissan.” Yet, while this obsession has propelled Honda forward, it has also constrained its flexibility.

If any infringement occurs, please contact us for deletion

Trending News

Proton e.MAS 7 OTA upgrades to Flyme Auto 1.2.0, completing the Android Auto interconnection ecosystem

Proton has officially released the Flyme Auto 1.2.0 version OTA update for e.MAS 7 users. The core of this upgrade is the addition of support for Android Auto, offering both wired and wireless connection options. Combined with the previously integrated Apple CarPlay feature, it achieves full coverage of the two major smartphone ecosystems, Android and Apple. This marks a step towards perfecting the smart cockpit experience of the e.MAS 7 all-electric SUV and is also a key milestone in Proton's phased software iteration plan.

2026 New Proton S70 Upgrades from Three-cylinder to Four-cylinder, Significantly More Powerful!

Proton's 2026 S70 to be launched before Lunar New Year, with a key upgrade to a 1.5-liter four-cylinder turbocharged engine replacing the three-cylinder model, improving power smoothness, maintaining spaciousness, with the infotainment system and driver assistance possibly adapted to local road conditions, offering practical improvements tailored to the needs of Malaysian and Thai family users, aiding car purchase decisions.

In 2026, Should I Buy a Proton X50 or a Perodua Traz? Can the RM 6,000 Rebate Offset the Traz's Space Advantage?

Recently, one of the most frequently asked questions in the Malaysian market is: So, should you go for the Proton X50, which offers stronger performance and a greater sense of technology, or the Perodua Traz, which provides more space and is more budget-friendly? Especially considering the X50 has discounts of up to around RM 6,000, how significant is the price difference left to weigh? This article provides an objective analysis from the perspective of daily usage.

Toyota Estima to return in 2026?

Since it was discontinued in 2019, news about the return of the Toyota Estima to the market has never stopped. Although Toyota has not yet released any official announcements regarding mass-production vehicles, the related information does not come from scattered rumors but originates from continuous revelations by Japanese automotive media.

Why do Malaysians prefer the Toyota 2NR-VE engine?

When choosing a family car in Malaysia, locals have an unwritten standard: "Don't look at how good the performance parameters are, just see if it can run smoothly for ten years."

Popular Cars

Model Year

Car Compare

Car Photo