BYD entered Malaysia for three years and has sold a total of 25,000 electric vehicles

MichaelDec 10, 2025, 03:34 PM

MichaelDec 10, 2025, 03:34 PM

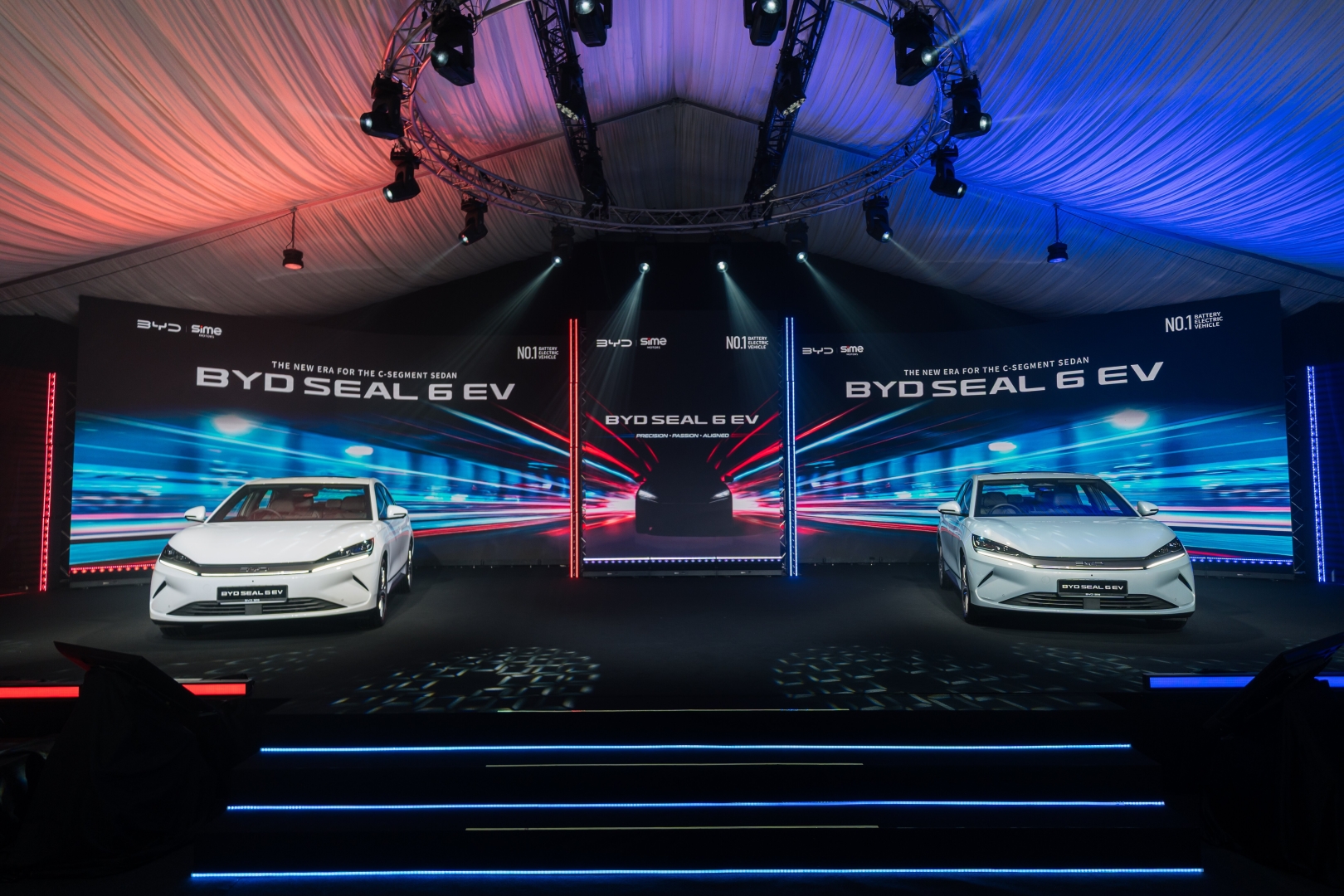

【PCauto】BYD’s official distributor in Malaysia, BYD Sime Motors, recently celebrated its significant milestone of three years in the market.

As the current sales leader among electric vehicle brands in the Malaysian market, the company announced cumulative deliveries exceeding 25,000 units.

A Diverse Model Range: Key to BYD's Success

From initially offering only the Atto 3 to now boasting a seven-model lineup, BYD has established its product portfolio in just 36 months—a process that typically takes traditional automakers over five years.

The newly launched Atto 2 (starting at 476,000 MYR) has lowered the electrification threshold for consumers, while the upgraded Seal, with its 700-kilometer range, has consolidated BYD's position in the high-end market.

Building a Mature Service Network Through Sime Motors

"Behind 25,000 choices is the trust of 25,000 families." This statement from BYD Malaysia's Managing Director, Eagle Zhao, reveals a deeper market rationale.

In Malaysia, where the per capita GDP has just surpassed $12,000, purchasing an electric vehicle remains a major household decision. Leveraging Sime Motors' existing 39 sales outlets and 24 service centers, BYD has established a comprehensive nationwide 'purchase-charging-maintenance' ecosystem.

Its centralized parts warehouse maintains a 94% supply rate, significantly alleviating owners' concerns about after-sales service.

The synergy between BYD and Sime Motors is particularly noteworthy. As one of Malaysia's oldest automotive retailers, Sime Motors' localized experience perfectly complements BYD's strengths as a manufacturing newcomer.

"We have trained 1,000 local technicians specializing in EV technology," revealed Sime Motors Southeast Asia Managing Director Jeffrey Gan. "This has reduced EV repair times by 40% compared to the industry average."

BYD to Build ASEAN's First Vehicle Manufacturing Base in Malaysia

The year 2026 will mark a strategic turning point for BYD in Malaysia. The planned 600,000-square-meter factory in Tanjong Malim will not only be BYD's first vehicle manufacturing base in ASEAN but will also drive the formation of a complete local electric vehicle industry chain.

According to industry insiders, once operational, the factory could create 3,000 direct jobs and increase the local content rate for BYD vehicles in the region to 40%, potentially leading to a 10-15% reduction in end-user prices.

As the Malaysian government's tax exemption policy for imported electric vehicles is about to expire, BYD has recently introduced purchase discounts of up to 20,000 MYR.

This "policy window" marketing strategy not only boosts short-term sales but also helps secure market share ahead of local production in 2026.

Data shows that Malaysia's electric vehicle penetration rate has risen from 0.8% in 2022 to 4.2% by Q3 2025—a remarkable growth rate in a Southeast Asian market still dominated by internal combustion engine vehicles.

If any infringement occurs, please contact us for deletion

Trending News

Perodua Myvi and Bezza may undergo major upgrades in 2026

After the update, the Bezza will no longer be just a low-cost alternative but a core model in the Perodua system with greater market competitiveness and brand premium potential. The upgrade of the Myvi is not to be unconventional but to strengthen the brand and market, ensuring that the Myvi continues to maintain its irreplaceable position in the new round of product competition.

Perodua Traz VS Ativa, which one is more worth buying?

Traz, as a newly launched mid-sized SUV, offers more spacious room and mainstream power compared to small SUVs, but its pricing appears slightly higher than that of Ativa. Ativa, on the other hand, is Perodua's long-time best-selling small SUV with more affordable pricing and a balanced combination of power and tech features.

Will the Toyota Yaris Cross come to Malaysia? If it comes, how much will it sell for?

The launch of Perodua Traz indicates that the market size of small SUVs in Malaysia has been expanding in recent years. However, the question naturally shifts back to Toyota. As a brand with the most comprehensive product line and a strong foundation in both the SUV and hybrid sectors, will Toyota choose the Yaris Cross to participate in this small SUV competition?

Perodua Traz VS Toyota Yaris Cross, where does the Traz fall short?

Before the official launch of the Perodua Traz, market expectations were actually very high because it shares the same DNGA platform as the Toyota Yaris Cross. However, sharing the same platform does not equate to the same experience, and the Traz's final performance has indeed been disappointing. Perhaps it is precisely because of the delayed launch that it has almost no competitiveness in the current competitive environment.

Why is the Toyota Sienna so popular with so many people?

In Malaysia, most family MPVs choose Toyota Alphard, Vellfire, or Kia Carnival. These models each have their advantages in luxury, space, or brand influence, but models that truly balance large space, multifunctional practicality, fuel efficiency, and reliability are rarely seen.

Popular Cars

Model Year

Car Compare

Car Photo