Nissan sells Rosslyn plant in South Africa to Chery SA

WilliamJan 27, 2026, 10:38 AM

WilliamJan 27, 2026, 10:38 AM

【PCauto】On 23 January, Nissan announced the sale of its Rosslyn plant in South Africa to Chery South Africa. Subsequently, its business model in South Africa will transition to a sales and distribution model, continuing to offer new products and services in the local market.

The Rosslyn plant, built in 1966, has long served as an important production base for Nissan in Africa.

From producing various local models such as Datsun and Nissan to the Fiat Uno and Renault Sandero, the plant carries a 60-year manufacturing legacy for the brand.

However, due to risising competition in the global automotive industry and shifts in market demand, Nissan’s operational performance in South Africa has faced increasing pressure.

In 2025, Nissan’s sales in South Africa totalled only 15,085 units, a year-on-year decline of 32.3%. Its market share dropped from 4.3% to 2.5%, falling to 12th place in local sales rankings.

In contrast, Chery’s sales in the South African market reached 25,304 units, a year-on-year increase of 26.7%, with its market share rising to 4.2% – underscoring Nissan’s diminishing competitiveness in South Africa.

As a result, Nissan decided to sell the Rosslyn plant and shift its business focus from local production to import and distribution operations.

The declining utilisation rate of the Rosslyn plant, rising production costs, and growing uncertainties in the global supply chain have made local production economically unviable.

Jordi Vila, President of Nissan Africa, noted that external factors have significantly impacted the utilisation and long-term viability of the Rosslyn plant within Nissan’s operations.

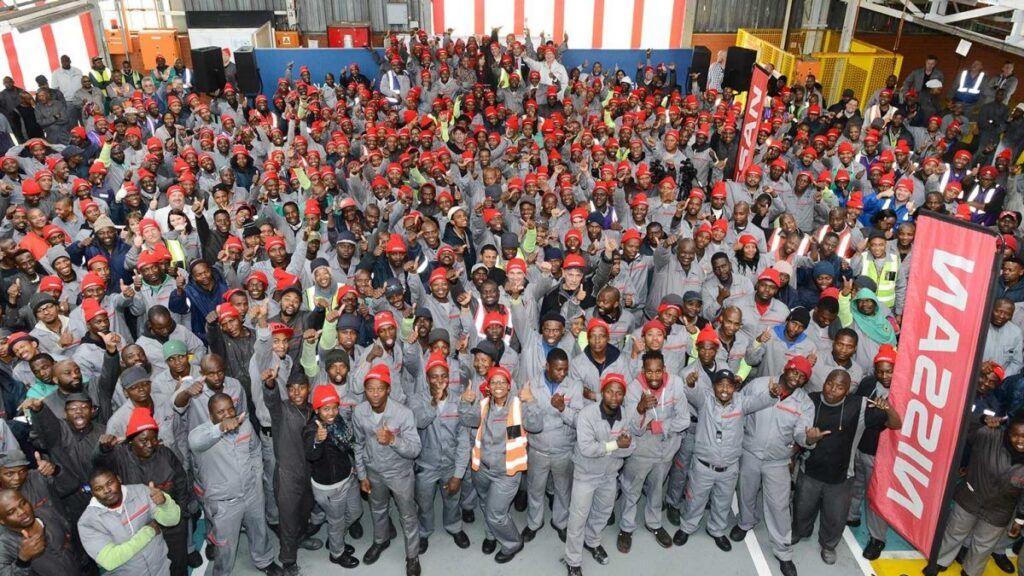

Through this agreement, Nissan can provide employment opportunities for most workers, maintain the supplier network, and ensure the plant continues to support South Africa’s automotive industry.

The transaction agreement stipulates that most existing Nissan employees will continue to be employed by Chery SA, with their remuneration remaining largely in line with current contracts.

This provides short-term job security for thousands of skilled workers and their related supply chains, while also laying the groundwork for Chery’s rapid entry into local production.

Regarding model production plans, Chery has not yet announced specifics, but it is anticipated that local production will help reduce costs, avoid import duties, and strengthen its market share in South Africa’s rapidly growing market.

The sale of the Rosslyn plant is part of Nissan's global business adjustments. Starting in 2025, Nissan launched the global “Re: Nissan” plan, which includes laying off 20,000 employees and closing seven production plants, aimed at optimising capacity utilisation and improving profitability.

In the South African market, Nissan will transition to an importer role, continuing to offer vehicle sales, spare parts, and after-sales services to ensure market continuity.

During the 2026 fiscal year, Nissan will introduce new models in South Africa, including the Nissan Tekton and the next-generation Nissan Patrol, to keep its product lineup competitive.

The current flagship model, the Navara pickup, is expected to be imported from Thailand, which could affect pricing and delivery timelines.

This plant sale reflects how traditional international brands like Nissan are withdrawing from manufacturing bases that struggle to achieve profitable scale or hold a lower strategic priority. Meanwhile, leading Chinese brands like Chery are entering a new phase of acquiring and repurposing these assets, leveraging their product and cost advantages.

Similar acquisitions may become more frequent in the future, but the key to success lies not in the acquisition itself, but in post-acquisition localised operations and sustained product competitiveness.

If any infringement occurs, please contact us for deletion

Trending News

Perodua Myvi and Bezza may undergo major upgrades in 2026

After the update, the Bezza will no longer be just a low-cost alternative but a core model in the Perodua system with greater market competitiveness and brand premium potential. The upgrade of the Myvi is not to be unconventional but to strengthen the brand and market, ensuring that the Myvi continues to maintain its irreplaceable position in the new round of product competition.

Perodua Traz VS Ativa, which one is more worth buying?

Traz, as a newly launched mid-sized SUV, offers more spacious room and mainstream power compared to small SUVs, but its pricing appears slightly higher than that of Ativa. Ativa, on the other hand, is Perodua's long-time best-selling small SUV with more affordable pricing and a balanced combination of power and tech features.

Will the Toyota Yaris Cross come to Malaysia? If it comes, how much will it sell for?

The launch of Perodua Traz indicates that the market size of small SUVs in Malaysia has been expanding in recent years. However, the question naturally shifts back to Toyota. As a brand with the most comprehensive product line and a strong foundation in both the SUV and hybrid sectors, will Toyota choose the Yaris Cross to participate in this small SUV competition?

Perodua Traz VS Toyota Yaris Cross, where does the Traz fall short?

Before the official launch of the Perodua Traz, market expectations were actually very high because it shares the same DNGA platform as the Toyota Yaris Cross. However, sharing the same platform does not equate to the same experience, and the Traz's final performance has indeed been disappointing. Perhaps it is precisely because of the delayed launch that it has almost no competitiveness in the current competitive environment.

Why is the Toyota Sienna so popular with so many people?

In Malaysia, most family MPVs choose Toyota Alphard, Vellfire, or Kia Carnival. These models each have their advantages in luxury, space, or brand influence, but models that truly balance large space, multifunctional practicality, fuel efficiency, and reliability are rarely seen.

Popular Cars

Model Year

Car Compare

Car Photo