The chip supply crisis in the automotive industry will hit again in 2026

Kevin WongJan 29, 2026, 03:56 PM

Kevin WongJan 29, 2026, 03:56 PM

[PCauto] The automotive industry in 2026 will be overshadowed by a fresh wave of anxiety. Reports from UBS analyst David Lesne, S&P Global’s annual outlook, and actual adjustments on the supply chain side of numerous automakers all point to the same conclusion: the chip shortage crisis has not truly ended; instead, it has resurfaced in an entirely new form.

The AI Industry Causes High-End Chip Shortages

This time, the crisis is more targeted and more challenging than the chip shortage of 2021. The three major memory chip giants—Samsung, SK Hynix, and Micron—are prioritizing supplies to the highly profitable data center sector due to the explosive demand from artificial intelligence (AI) and hyperscale data centers, directly widening the supply gap for DRAM chips in the automotive industry.

A supply chain executive from a Chinese automaker has issued a warning that the supply satisfaction rate for such chips in the automotive industry may drop below 50% in 2026, and their prices are showing a quarterly inflation trend. UBS data shows that some DRAM chips have already seen prices surge by up to 180%.

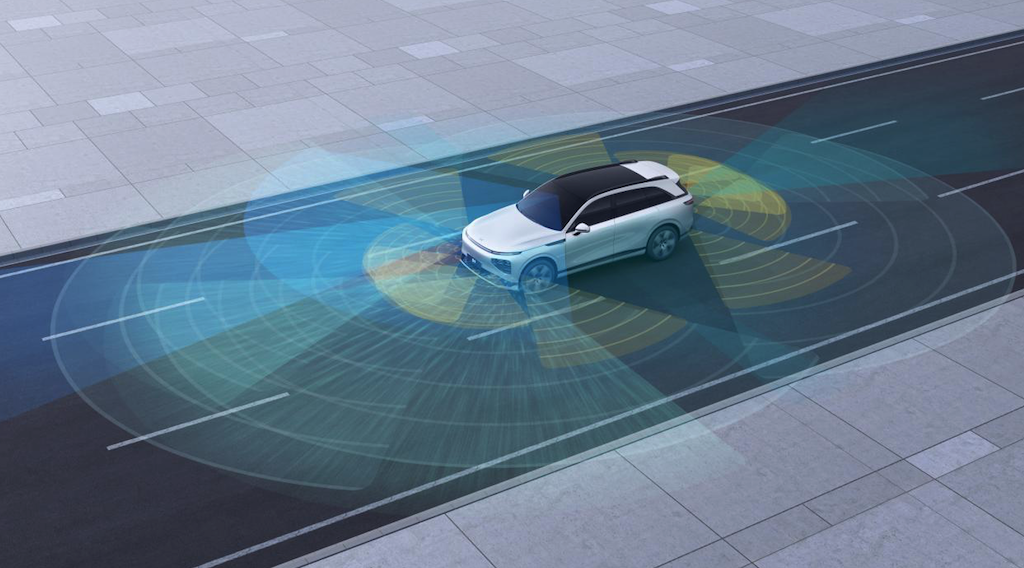

Currently, the DRAM value in each vehicle ranges from $25 to $150, and the proliferation of intelligent driving systems is driving this demand to grow exponentially. UBS warns that memory chip supply disruptions could emerge as early as Q2 2026.

This Chip Crisis Will Mainly Affect Vehicles with Intelligent Driving Features

The 2021 chip shortage, caused by the pandemic and demand misjudgments, mainly involved low-end, mature-node chips such as MCUs (microcontroller units) and power management ICs. It impacted the entire industry indiscriminately, from low-cost vans to high-end luxury cars, with the core challenge being that automakers couldn’t buy chips even if they had money.

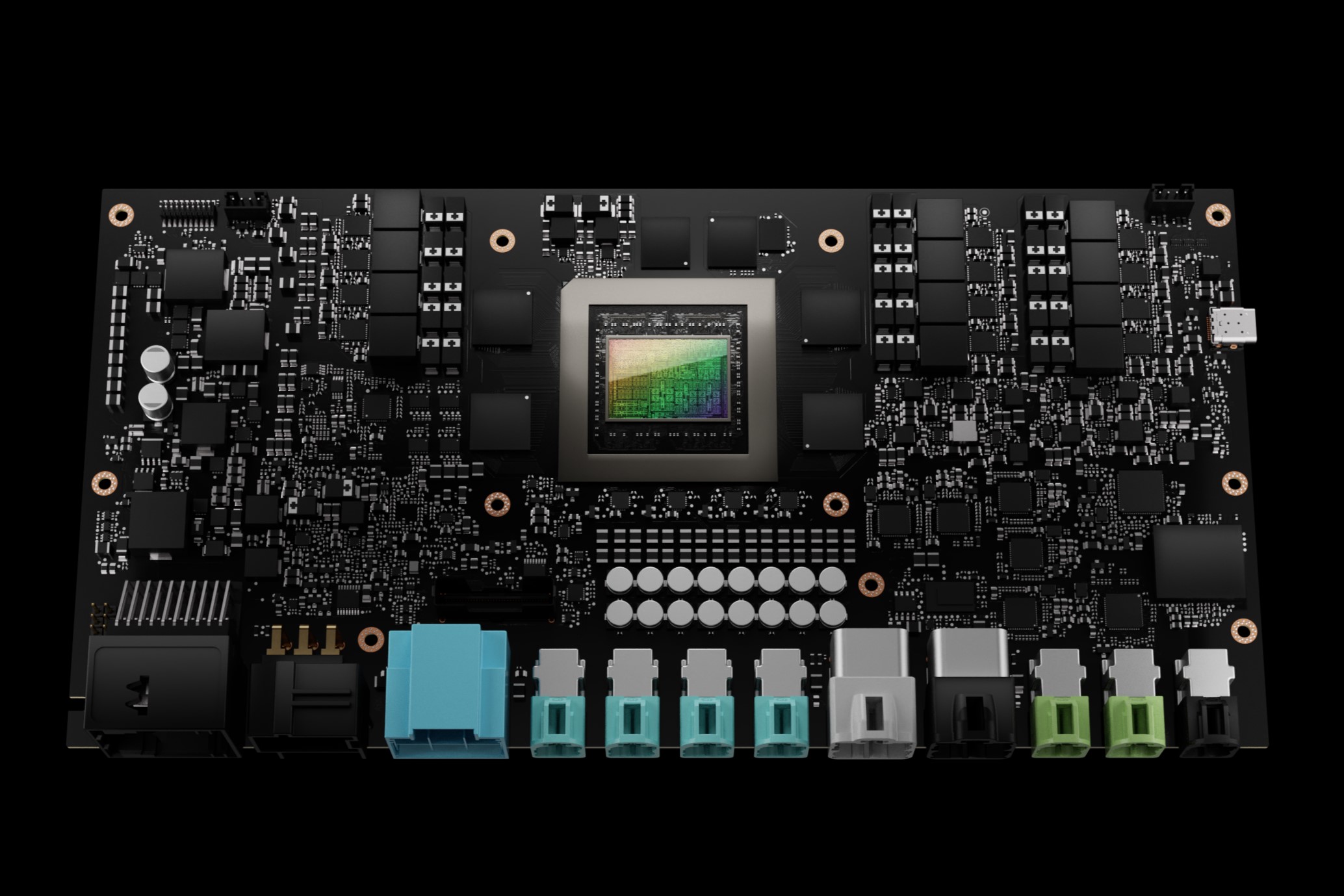

However, the 2026 shortage involves high-end memory chips such as DRAM and HBM, alongside AI computing chips—cutting-edge process products that are essential for intelligent vehicles.

This explains why the impact is so concentrated, mainly affecting car manufacturers that heavily rely on electronic architecture. The greater the dependency, the larger the impact. UBS highlighted Tesla and Rivian as facing significantly higher downside risks than traditional manufacturers such as GM and Ford. Smart cockpit suppliers such as Visteon were also included on the high-risk list.

Carmakers face an added challenge: the operating environments during these two crises are fundamentally different. During the chip shortage in 2021, market demand exceeded supply, leading car companies to generally cancel discounts or even raise prices, achieving record profits.

In the 2026 market, not only is demand weak, but the industry is also caught in a vicious price war. Even if car companies manage to secure high-priced storage chips, they face the predicament of losing money on every car sold.

From a technological perspective, there is no viable substitute. During the 2021 chip shortage, car manufacturers could cope by reducing features, such as replacing electric seats with manual ones or using monochrome dashboards instead of color ones. With fewer features, cars could still be produced.

However, the storage chips missing this time are the core of intelligent driving. Without these chips, advanced intelligent functions simply cannot function. Yet, eliminating core features would strip the vehicles of their selling points—this is the most troubling aspect for car companies.

In this context, the industry landscape has naturally shifted. Traditional fuel vehicles and conventional hybrids (HEVs), with their low reliance on high-end storage chips, have shown far greater resilience than pure electric vehicles.

As a result, the rules of the automotive industry in 2026 have changed. Previously, competition centred on who sold more vehicles. Now, it hinges on who can secure chips and withstand costs without losing money. For this reason, traditional fuel vehicles and conventional hybrid models, which rely less on high-end chips, have a stronger ability to resist risk compared to pure electric vehicles.

The cost pressure from chip price hikes will gradually pass through to the end market within 2026, either through higher retail prices or smaller car purchase discounts.

A report from S&P Global Mobility anticipates a rare decline in global light vehicle production in 2026, which is the result of multiple factors including storage chip shortages, overstretched purchasing power, policy cooldowns, and the costs of deglobalization.

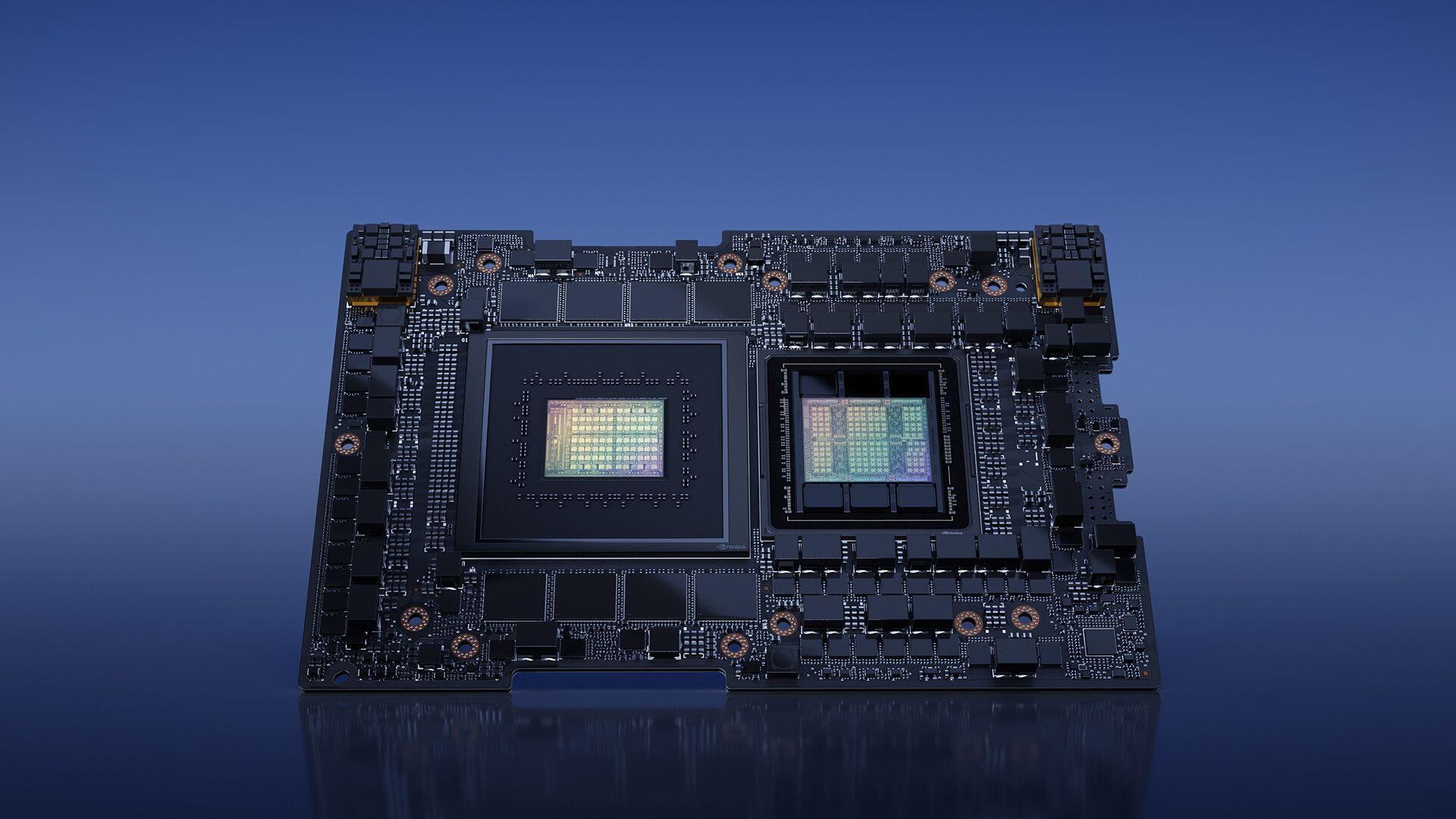

This crisis is not merely about production capacity; it is about scarce high-end chips being diverted to the more profitable AI sector—a natural outcome of industrial evolution.

Previously, car manufacturers were competing for chips with consumer electronics companies, but now they must compete with AI giants like NVIDIA, with hardly any advantage, leaving them with little recourse but to adapt.

If any infringement occurs, please contact us for deletion

Trending News

Perodua Myvi and Bezza may undergo major upgrades in 2026

After the update, the Bezza will no longer be just a low-cost alternative but a core model in the Perodua system with greater market competitiveness and brand premium potential. The upgrade of the Myvi is not to be unconventional but to strengthen the brand and market, ensuring that the Myvi continues to maintain its irreplaceable position in the new round of product competition.

Perodua Traz VS Ativa, which one is more worth buying?

Traz, as a newly launched mid-sized SUV, offers more spacious room and mainstream power compared to small SUVs, but its pricing appears slightly higher than that of Ativa. Ativa, on the other hand, is Perodua's long-time best-selling small SUV with more affordable pricing and a balanced combination of power and tech features.

Will the Toyota Yaris Cross come to Malaysia? If it comes, how much will it sell for?

The launch of Perodua Traz indicates that the market size of small SUVs in Malaysia has been expanding in recent years. However, the question naturally shifts back to Toyota. As a brand with the most comprehensive product line and a strong foundation in both the SUV and hybrid sectors, will Toyota choose the Yaris Cross to participate in this small SUV competition?

Perodua Traz VS Toyota Yaris Cross, where does the Traz fall short?

Before the official launch of the Perodua Traz, market expectations were actually very high because it shares the same DNGA platform as the Toyota Yaris Cross. However, sharing the same platform does not equate to the same experience, and the Traz's final performance has indeed been disappointing. Perhaps it is precisely because of the delayed launch that it has almost no competitiveness in the current competitive environment.

Perodua Traz 2025:Spec, Price and Features

Perodua Traz has been officially launched in Malaysia. It is a B-segment five-seater SUV built on the DNGA platform. Compared to the Yaris Cross, which emphasizes brand and quality, the Traz comes with a localized rate of about 95%, offering a more friendly price and practical features.

Popular Cars

Model Year

Car Compare

Car Photo